- Home

- About Us

-

News

- Company News

- Media Highlights

- Industry Information

- CR Group News

- Business

- Innovation

- IR

- Sustainability

-

Talent Development

- Talent Philosophy

- Talent Training

- Talent Recruitment

- Financial Overview

- Reports & Presentations

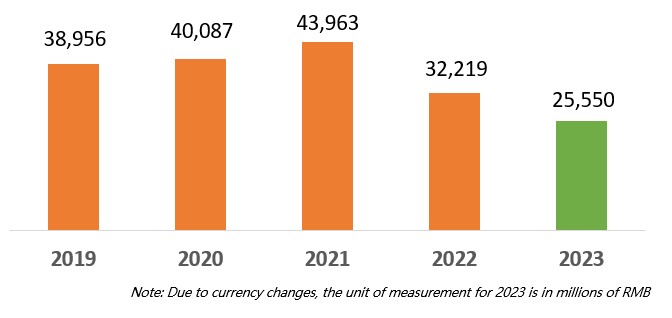

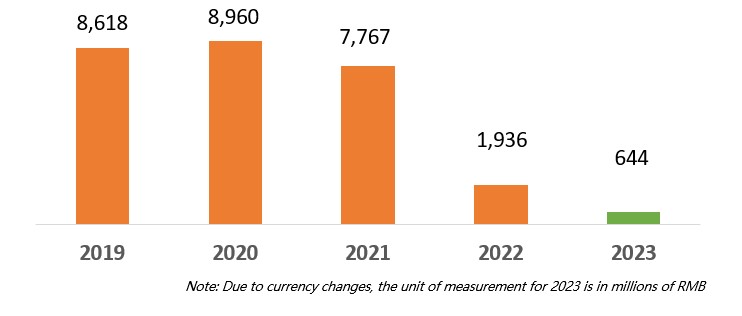

| Consolidated Statement of Income | |||||

|---|---|---|---|---|---|

| Unit: HK$ Million | 2023 | 2022 | 2021 | 2020 | 2019 |

| Turnover | 25,550 | 32,219 | 43,963 | 40,087 | 38,956 |

| Cost of Sales | (21,788) | (27,300) | (29,840) | (24,451) | (23,298) |

| Gross Profit | 3,762 | 4,919 | 14,123 | 15,636 | 15,658 |

| EBITDA | 4,082 | 5,228 | 12,368 | 13,607 | 14,041 |

| Profit before Taxation | 914 | 2,282 | 10,291 | 11,893 | 12,008 |

| Taxation | (295) | (420) | (2,566) | (2,864) | (3,314) |

| Profit Attributable to Owners of the Company | 644 | 1,936 | 7,767 | 8,960 | 8,618 |

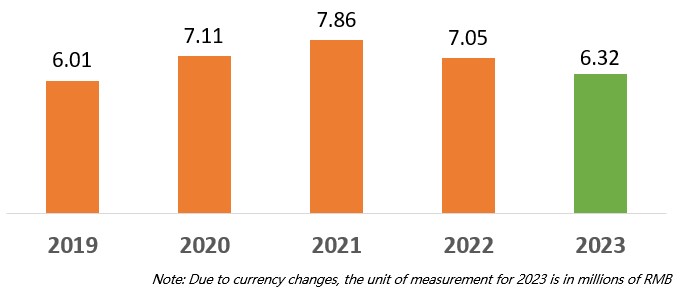

Note: Due to currency changes, the unit of measurement for 2023 is in millions of RMB.

| Consolidated Statement of Financial Position | |||||

|---|---|---|---|---|---|

| Unit: HK$ Million | 2023 | 2022 | 2021 | 2020 | 2019 |

| Total Assets | 72,792 | 80,614 | 79,149 | 68,532 | 61,171 |

| Current Borrowings | 3,290 | 4,548 | 9,051 | 3,564 | 1,298 |

| Non-current Borrowings | 16,065 | 11,885 | 1,362 | 3,300 | 6,628 |

| Total Liabilities | 27,045 | 29,773 | 23,508 | 18,509 | 18,905 |

Note: Due to currency changes, the unit of measurement for 2023 is in millions of RMB.

| Consolidated Statement of Cash Flows | |||||

|---|---|---|---|---|---|

| Unit: HK$ Million | 2023 | 2022 | 2020 | 2020 | 2019 |

| Net Cash Generated from Operating Activities | 3,918 | 3,170 | 6,034 | 10,268 | 11,285 |

| Net Cash Used in Investing Activities | (4,675) | (10,335) | (11,731) | (5,004) | (2,618) |

| Net Cash Used in Financing Activities | 1,410 | (2,696) | (755) | (5,688) | (7,837) |

| Cash and Bank Balances | 2,604 | 2,182 | 7,067 | 13,227 | 12,848 |

Note: Due to currency changes, the unit of measurement for 2023 is in millions of RMB.

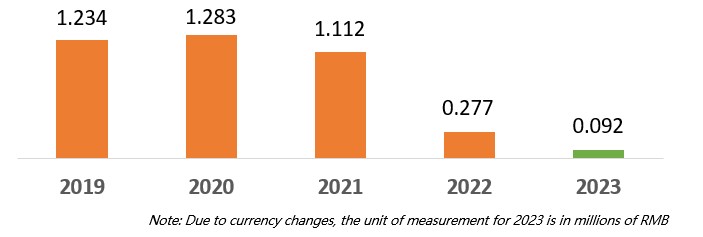

| Key Ratios | |||||

|---|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Gearing Ratio (Note 1) | 36.9% | 33.4% | 19.0% | 13.8% | 18.9% |

| Net Gearing Ratio (Note 2) | 30.0% | 27.9% | -13.6% | -13.6% | -12.2% |

| Gross Margin (Note 3) | 14.7% | 15.3% | 32.1% | 39.0% | 40.2% |

| Profit Margin (Note 4) | 2.4% | 5.8% | 17.7% | 22.5% | 22.3% |

Note:

1.Gearing ratio is calculated by dividing the total bank borrowings and unsecured medium term notes by equity attributable to owners of the Company.

2.Gearing ratio is calculated by dividing the total bank borrowings, unsecured bonds, unsecured commercial paper and unsecured medium term notes by equity attributable to owners of the Company.

3.Gross margin is calculated by dividing gross profit for the year by turnover.

4.Profit margin is calculated by dividing profit for the year by turnover.